Last update: 09/04/2025

Santander Corporate & Investment Banking (Santander CIB) is our global business that provides corporate and institutional clients with customized solutions and high added value wholesale products that meet their complex needs.

Underlying profit

Total revenue

Loans

Efficiency

RoTE

Underlying profit

Total revenue

Loans

Efficiency

RoTE

Santander CIB harnesses the Group’s strengths, local and global scale and diversification to enhance the service we give to our corporate and Institutional clients. It is also the leader in renewable energy and export financing.

Santander CIB’s proposition as the world’s leading wholesale bank covers a wide range of high added value solutions for corporate and institutional clients, as well as serving the Group’s broad client base through cooperation with other segments.

Check out more of what Santander CIB has to offer:

In 2024 we upgraded our centres of excellence and boosted client engagement, with a strong focus on our Global Markets strategy and US growth target. Santander CIB's growth and transformation puts us in the best position to advise our clients.

In 2024, Santander CIB’s revenue climbed to EUR 8,343 million, with profits of EUR 2,740 million (up 12% year on year). These were record figures, with double-digit annual growth that all business lines contributed to. Moreover, it made significant headway thanks to its key growth levers: globalization of markets and businesses and expansion of its advisory services in the US.

In Global Transaction Banking, intense activity in Export Finance and Trade & Working Capital Solutions more than offset a drop-off in activity in Cash Management, which was hit by falling interest rates. We also performed well in Global Banking, backed by growth in Corporate Finance (CF) and Global Debt Financing (GDF).

2024 results

Customer experience

To be a trustworthy adviser for our clients by harnessing our global solutions and local presence and knowledge.

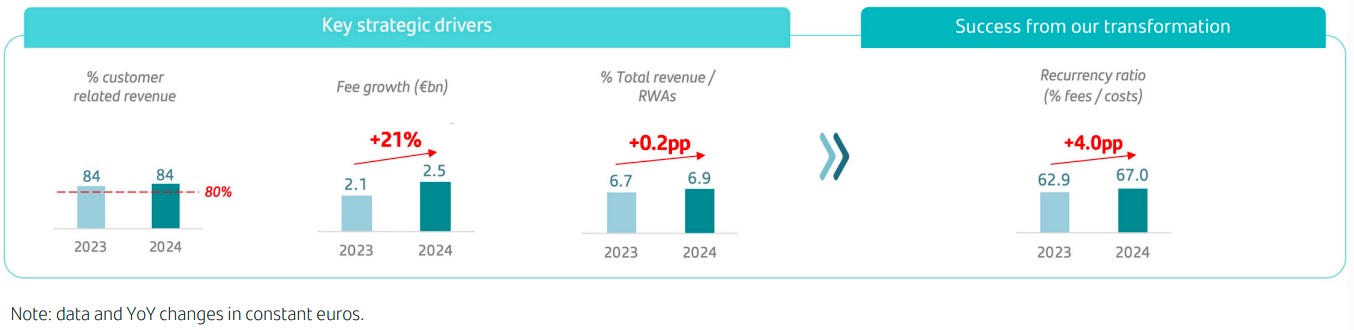

Operational leverage

To continue growing the fees and transactional banking business through our global centres of excellence and technology.

Global platform

To optimize return on equity thanks to our global origination and distribution capability.

2025 priorities

- Deepen our relationship with clients, especially in the US.

- Get the most out of our upgraded centres of excellence, increase connectivity based on client needs, and digitalize our business further.

- Continue enhancing active capital management and global operational models.

- Attract, develop and retain the best talent.