Last update: 09/04/2025

Comprised of two entities: PagoNxt, which includes Getnet, Ebury and PagoNxt Payments; and Global Cards, which houses the cards business and card issuing platform in the markets where we operate.

Total revenue

Total revenue

Payments brings together PagoNxt’s digital payment solutions and the Global Cards business. Combined, they give the Group an unrivalled position in the payments sector by covering both sides of the value chain through card payments (issuer and acquirer) and account-to-account payments.

This global business provides innovative technology solutions for our banks and new customers in the open market. With unique infrastructure and global payment platforms, we remain at the forefront of the sector by driving efficiency and innovation. This enables us to forge stronger ties with our customers and create long-term value.

Total Revenue

EBITDA margin

Total Payments Volumes (Getnet)

Total Revenue

EBITDA margin

Total Payments Volumes (Getnet)

PagoNxt

We offer solutions for strategic business and high-growth segments through:

- Getnet: Our in-store payments business that operates in Europe (Portugal and Spain) and Latin America (Argentina, Brazil, Chile, Mexico and Uruguay), where it’s the second-largest acquirer by number of transactions. Getnet offers global, integrated acquiring, processing and value-added solutions for brick-and-mortar and online stores.

- PagoNxt Payments: Global account-to-account (A2A) payments platform for instant payments, processing, FX, and other services.

- Ebury, a global platform for SMEs to make international payments in several currencies.

We’re a unique payment tech business that offers innovative solutions and helps customers prosper and grow quicker.

of cards in circulation in the world

RoTE

of cards in circulation in the world

RoTE

Global Cards

At Global Cards, we make headway with our strategic priorities based on these three pillars:

- Grow the cards business profitably by focusing on credit cards and the retail cards segment and optimizing the value of data through AI-based models.

- Enhance the payments experience with advanced solutions that offer simpler, faster and more secure payment methods through “invisible payments”.

- Build a global card issuing platform (Plard) with cutting-edge technology, based on the cloud and real-time processing. The main aims are to reduce issuing and processing costs, enhance the payment experience and grow revenue by using state-of-the-art capabilities and functionalities.

We offer an outstanding payment experience that brings us closer to our customers and harnesses transactional data to boost profitability.

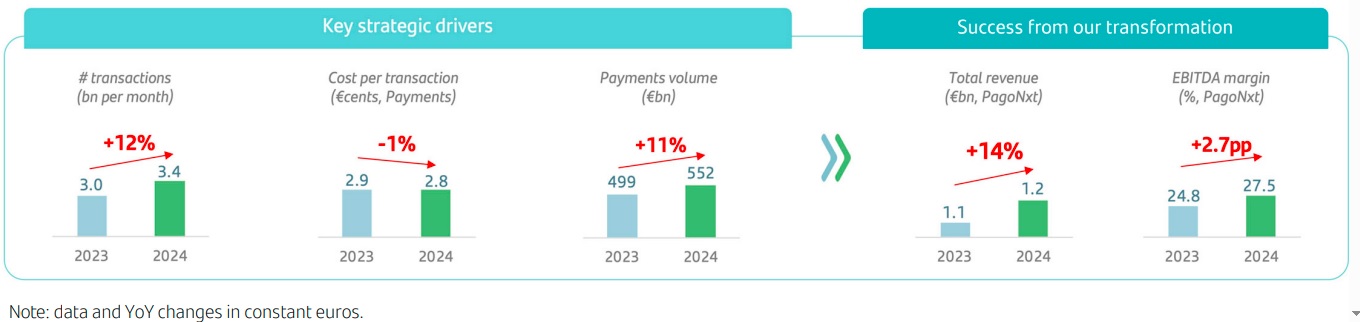

2024 results

Customer experience

To offer the best payments solutions by leveraging our global and local scale.

Operational leverage

To reduce the cost per transaction by optimizing investment and operational efficiency.

Global platform

To migrate volumes to common platforms to achieve scale and offer competitive prices in the open market.

2025 priorities

PagoNxt:

- Broaden our innovative payments platform and value-added, integrated solutions.

- Roll out our global payments platform to all our regions and to the open market.

Cards:

- Expand our cards business while enhancing customer experience.