Last update: 09/04/2025

Consumer drives a single model across all our markets for the interconnected businesses: auto financing, consumer lending, supported by Zinia, and Openbank, our 100% digital retail products and services proposition. Consumer offers the best customer experience and promotes our global relationships.

The Consumer global business, which is one of the Group’s growth drivers, is a world leader in consumer finance. It operates in 26 markets in Europe and the Americas and serves the point-of-sale (both physical and digital) and direct financing needs of over 25 million customers.

In 2024, we strengthened our leadership in the auto sector through global strategic alliances, the evolution of our digital auto services, the development of our leasing platform and the simplification of our auto operating model in Europe, with the ultimate aim of running a single common platform that makes us the most cost-efficient operator.

Revenue

Underlying profit

Loans

Efficiency

RoTE

Revenue

Underlying profit

Loans

Efficiency

RoTE

In non-auto lending, we’re a major player in consumer loans in both Europe and Latin America. We’re growing Zinia — our check-out lending technology that operates in Germany, through new agreements such as a co-branded card with Amazon and instalment loans with Apple.

In digital banking, Openbank’s ground-breaking digital and product capabilities are helping us expand rapidly into new markets with great potential to attract retail customer deposits. We launched Openbank in the US in 4Q’24. We’re also gearing up to inaugurate a branch in Germany (January 2025) and to launch Openbank fully in Mexico (February 2025) with a value proposition to compete with other neobanks.

Our priority is to continue expanding our leadership in consumer finance and to be the most competitive player, with the best customer experience through a more digital global operating model and the best solutions through common platforms.

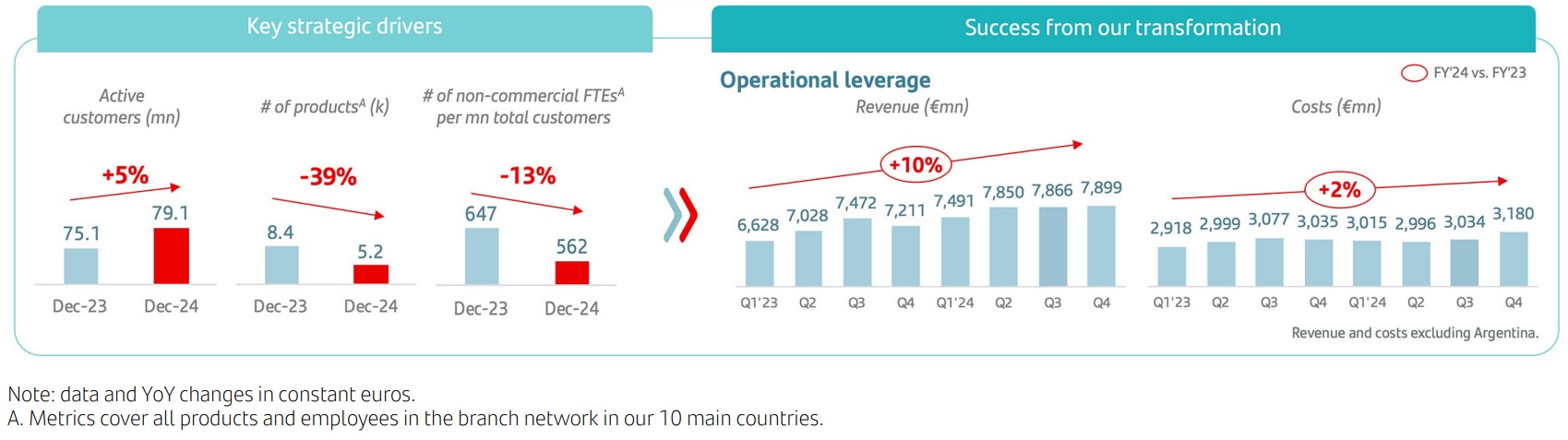

In 2024, Digital Consumer Bank registered revenue of EUR 12,916 billion on the back of growth in its activity. Its profit margin grew double-digit year on year, backed by strong revenue performance — net interest income up 6% and fees up 24% — and solid cost control (down 4% in real terms), which improved efficiency by 2.7 pp to 40.1%.

2024 results

Customer experience

Partnerships with Amazon and Apple.

Operational leverage

Following Group best practice in every unit.

Global platform

Launch of Openbank in the US.

2025 priorities

Our priority is to continue expanding our leadership in consumer finance and to be the most competitive in terms of costs, offering the best customer experience through a more digital global operating model and enhanced solutions (check-out lending, digital journeys in auto and leasing) through common platforms.

- Converge to global platforms.

- Grow and strengthen ties with partners.

- Promote a network effect through a comprehensive product proposition by leveraging the Group’s capabilities.

- Continue to capture deposits.

- Enhance and automate our originate-to-distribute model.