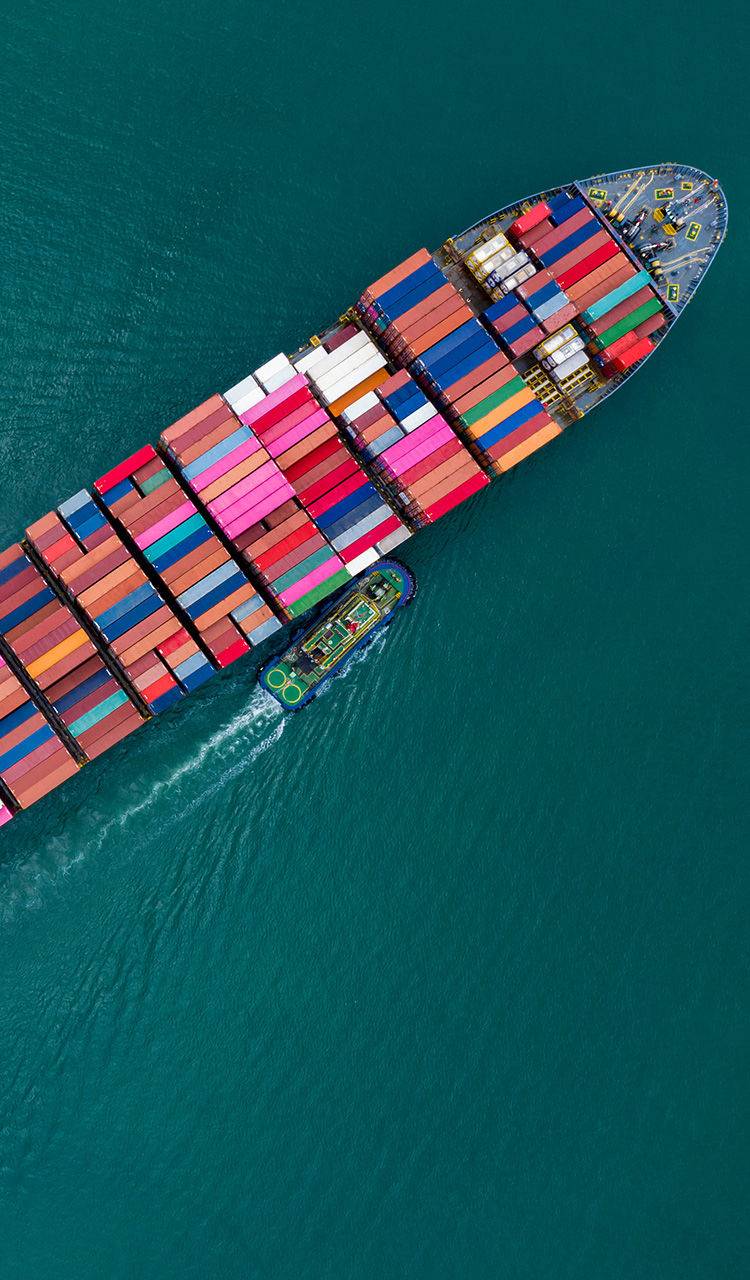

Increasing fragmentation of global trading blocs presents significant challenges to companies serving international markets – but shifting trade flows also offer opportunities to reengineer supply chains, forge new partnerships and build more sustainable businesses.

Forward-thinking business leaders had been quietly preparing for a new order in global trade well before the US announced new import tariffs. However, the scale of the charges has fuelled widespread concern about the impact on the global economy and on company finances.

In a volatile geopolitical climate, a growing number of businesses have begun to implement strategies and deploy technology designed to lower costs and to make supply chains more agile and resilient to the risk of disruption.

Even before the latest tariffs were unveiled, around 80% of global CEOs were planning significant supply chain changes, according to Conference Board’s C-Suite Outlook 2025 survey of 1,700 large company executives from North America, Europe, Asia and Latin America. That is a marked increase on the previous year.

Overall, changes are principally focused on using digital technology including Artificial Intelligence (AI) to improve performance tracking, although in the US the main focus is on vendor diversification.

We see many companies responding to greater uncertainty by developing a more diversified base of suppliers. This can mitigate the risk of supply disruption but it can also have negative impacts as you may be switching from a long-term trusted partner with whom you established good bargaining power to having to establish new relationships with multiple suppliers.

Bobo says companies must navigate a tricky transitional phase in which trading corridors are widening, with regionalisation emerging as a key trend along with ‘nearshoring’ – that is, favouring suppliers close to a company’s core operation.

Managing more fragmented supply chains has become increasingly complex, requiring digital tools and technologies such as AI which can deliver real-time insights and enable companies to make timely data-driven decisions.

Companies require access to finance to invest in digitalisation and to meet higher working capital requirements. They may have to negotiate payment terms with new suppliers who may demand guarantees or letters of credit.

“There was a huge increase in inventories before the tariff announcements as companies stockpiled supplies before prices rose and that has an impact on the balance sheet and working capital,” says Mencia Bobo. “Bargaining power is shifting too, which adds to complexity.”

Companies need to be in good financial and operational shape to overcome challenges and also to exploit opportunities arising from shifting world trade patterns and supply chain transformation.

Some companies are seeking to shorten supply chains and eliminate cost by cutting out distributors and pursuing direct-to-consumer sales models, with e-commerce at the heart of many such strategies.

The full impact of newly imposed and impending tariffs has yet to be seen, although the Organisation for Economic Cooperation and Development (OECD) has warned that a combination of tariffs, inflationary pressure and geopolitical tension would contribute to global growth slowing to 3.1% in 2025 and 3.0% in 2026.

However, there are several reasons to remain calm about the future, including the fact that growth is expected to continue both in terms of global GDP and the rising value of world trade. Also, data from UN Trade and Development (UNCTAD) shows that two-thirds of international trade occurs without tariffs.

Global trade hit a record $33 trillion in 2024, growing by 3.7% and DHL, the world’s largest logistics company, forecasts that global trade volumes will rise by an annual average of 3.1% from 2024 to 2029.

Historically, world trade has proven remarkably resilient to tariffs, slowing down initially for a year following the imposition of major new tariffs in 2018/19 before rebounding and posting consistent annual growth from 2019 to 2022.

Initiatives to boost free trade are gathering pace and momentum, with several new international agreements recently signed or under negotiation. These span several continents and major economies and provide an important counterbalance to protectionist measures.

Across the world, liberalisation of trade is delivering new opportunities for lower cost import and export activity as well as inward investment in strategically important locations.

Landmark developments include the EU-Mercosur partnership agreement signed in December 2024. It paves the way for Mercosur nations Argentina, Brazil, Paraguay and Uruguay and 27 nations of the European Union to boost trade and investment in a total market of almost 750 million people.

Even bilateral and multilateral trade talks that had been stalled for years have resumed in earnest with governments seeking rapid agreement and implementation.

India, the world’s fifth biggest economy is in the vanguard. It has revived talks on free trade agreements with both the UK and New Zealand and it is also seeking to finalise a free trade agreement with the EU this year.

These efforts follow the signing of $100 billion free trade agreement between India and EFTA countries (Norway, Switzerland, Iceland and Lichtenstein) in December 2024.

The UK has also just become the first European nation to join the Comprehensive and Progressive Agreement for Trans Pacific Partnership which comprises 11 founding member nations – Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, Vietnam – that jointly account for 15% of global GDP.

Africa also has ambitions to extend the scope of its existing African Continental Free Trade Area which ranks as one of the biggest free trade areas in the world, spanning 55 countries and 1.4 billion people.

Besides a proliferation of new trade agreements, there is evidence of a boom in intra-continental and intra-regional trade. For example, container freight shipping data show that for every seven ‘boxes’ shipped from Asia to elsewhere, a further eight are transported within Asia.

Bloomberg identified five nations as key ‘economic connectors’ that are attracting particularly strong trade flows and becoming magnets for new investment. The five are Vietnam, Poland, Morocco, Indonesia and Mexico.

The European Bank for Reconstruction and Development summed up four common characteristics of ‘connector’ nations as: competitive manufacturing capabilities; indirect access to major markets; geographic, cultural and political proximity to major geopolitical rivals, and use of special economic zones.

A cool-headed reappraisal of the relative strategic attractions of the five connector nations may be advised however, factoring in the potential impact of US tariffs.

Recent global developments may have cast a pall of uncertainty over the direction of future trade but there are also new and potentially lucrative opportunities on the near horizon for ambitious nations and businesses alike.