Call for action against $537 billion in global “fraudemic” report

A landmark study backed by Santander UK reveals the scale of a global “fraudemic” and the need for coordinated international action to beat the scammers. Santander continues to dedicate significant resource into protecting our customers.

One-in-five adults (21%) have been victims of fraudsters over a three-year period, according to a landmark global report which surveyed thousands of people across 15 countries.

The research shows $211 billion (£168 billion) falling into the hands of fraudsters in the ground-breaking research, ‘It’s a Fraudster’s World’.

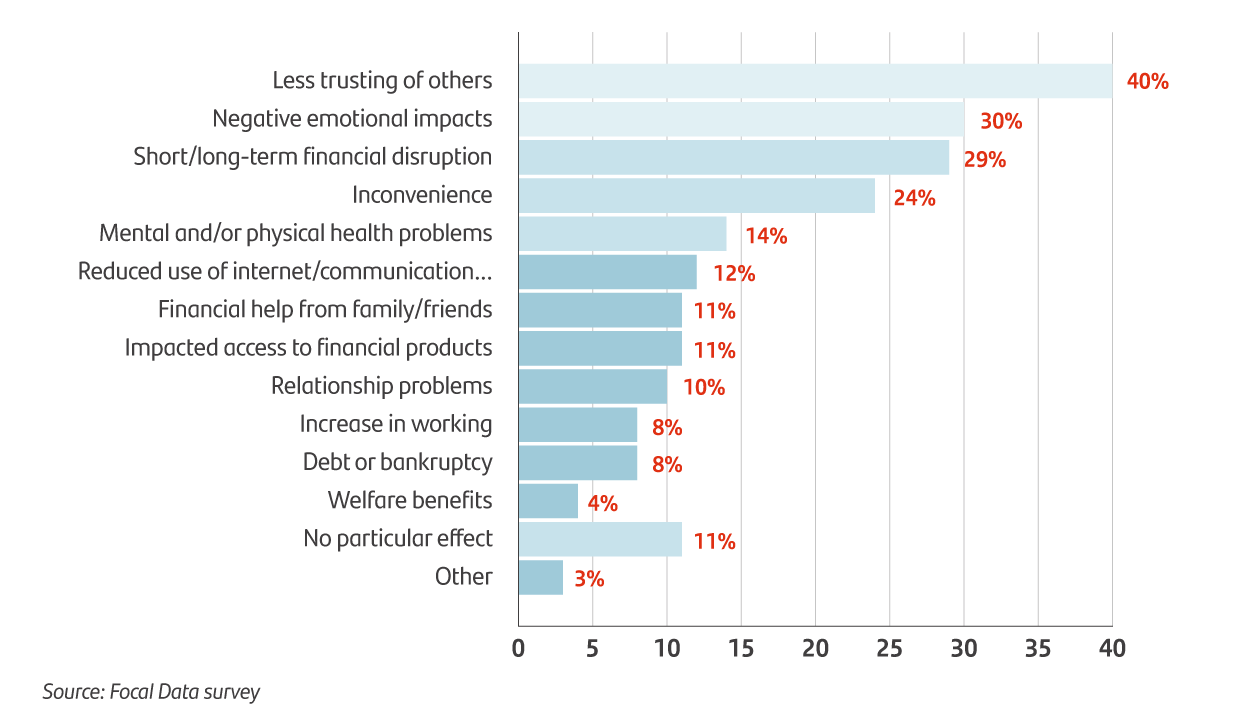

As well as losses to individuals, the report calculated the wider socio-economic cost of fraud across those nations – such as reductions in productivity from having to deal with the aftermath of fraud – were more than $537 billion (£420 billion). More information on the types of wider negative impacts experienced by fraud victims aggregated across the 15 countries, 2021- 2023, in the graph below.

Types of wider negative impacts experienced by fraud victims aggregated across 15 countries, 2021-2023

There are also debilitating emotional factors beyond money: 40% of respondents reported feeling less trusting of others after being targeted, while 12% reduced their use of the internet and communication technology as a result.

The report is the first of its kind - and was produced for Santander UK in partnership with the Social Market Foundation (SMF) a non-partisan think tank.

It is estimated that around 228 million people in the countries polled suffered from fraud at least once between 2021 and 2023. That equates to 76 million victims a year, with each typically losing around $1,356. The average loss was highest in Singapore and lowest in Brazil.

“Despite the best efforts of banks and policymakers, the criminal gangs who sit behind fraud are enriching themselves to the tune of billions and costing the global economy hundreds of billions,” says Stephen White, Chief Operating Officer at Santander UK. “Fraud has become a global phenomenon, as such it needs global, collective action.”

Potential solutions to tackle “fraudemic”

As well as calculating the scale of the fraudemic, the authors also attempted to find consensus for tackling the problem.

Across the countries polled, the public generally believed that all those in the “fraud chain” – banks and payment service providers, social media platforms, telecoms companies and internet providers – have a responsibility for compensating fraud victims for their losses.

Those in this chain are not the perpetrators of scams but their systems are potentially vulnerable to abuse.

International co-ordination on counter-fraud efforts is desperately needed given the ability of fraudsters to act across international boundaries, say the report authors.

“Our research presents the clearest picture yet of the scale of the global fraud problem,” says Richard Hyde, Senior Researcher at Social Market Foundation. “Any nation acting alone remains ill-equipped to deal with today’s fraudsters, who can operate from anywhere and claim a victim thousands of miles away.

“To tackle the challenge, governments across the world need to co-ordinate and put in place strong counter-fraud measures at home; this will create the best platform from which the world can deal with cross-border fraud.”

The report contains a series of recommendations to increase international collaboration and ensure that all states:

- Are aligned on the goal of tackling fraud.

- Agree on domestic measures which are needed and will be implemented.

- Galvanise those organisations that constitute the fraud chain to instigate the necessary measures to prevent and disrupt fraud.

- Prioritise cross-border collaboration between law enforcement and regulatory agencies.

The evidence presented in the report derived from representative polling of over 28,000 adults in 15 countries – Argentina, Australia, Brazil, Canada, France, Germany, Italy, Japan, Mexico, New Zealand, Portugal, Singapore, Spain, United Kingdom and the United States.

Fraud is committed on a vast scale around the globe

The US experienced the highest level of fraud, with 31% of adults falling prey to scammers, while only 8% of Japanese adults were affected, the lowest figure in the study.

Authorised Push Payment (APP) fraud, a type of scam which sees people tricked into sending a payment or making a transfer to fraudsters, was the most common crime experienced by victims across the nations studied.

The researchers found considerable support across all countries for both making fraud chain organisations share liability for the financial impact of individual crimes against consumers and imposing financial penalties when they fail to take effective steps to prevent and disrupt fraud.

Around 90% of respondents agreed that those in the fraud chain should bear some of the cost of fraud, while support for financial sanctions against organisations failing to take adequate counter-fraud steps was upwards of 63%.

Sharing of data between those in the fraud chain is viewed positively by consumers. The survey found that private data and intelligence sharing between financial services firms was the most consistently supported arrangement.

Enhanced security checks create “friction” which means transactions take longer to complete. According to one fraud specialist interviewed by researchers: “Where there is a concern or a risk flag or a warning, then the banks need longer than they now get to be able to make a decision based on an informed response to questions, rather than a guess.”

Data from the SMF research suggests that introducing measures such as stronger identity verification of both payers and payees would be accepted by most consumers.

However, there was less enthusiasm for slower payments so measures that delay transactions may need to be targeted based on risk rather than being implemented across the board.

The need for international cooperation to beat cybercriminals

All the measures proposed by the Social Market Foundation require coordinated action by financial institutions, payments and telecoms companies working in tandem with law enforcement and regulators.

Bringing all sides together is too much for one company, or even one country, so the report authors argue the United Nations could be the best forum to achieve collective action.

They believe a UN convention would encompass most countries and result in a high degree of compliance, resulting in a global crackdown on the scammers who bring misery to millions with casual indifference to the financial and emotional damage they cause.