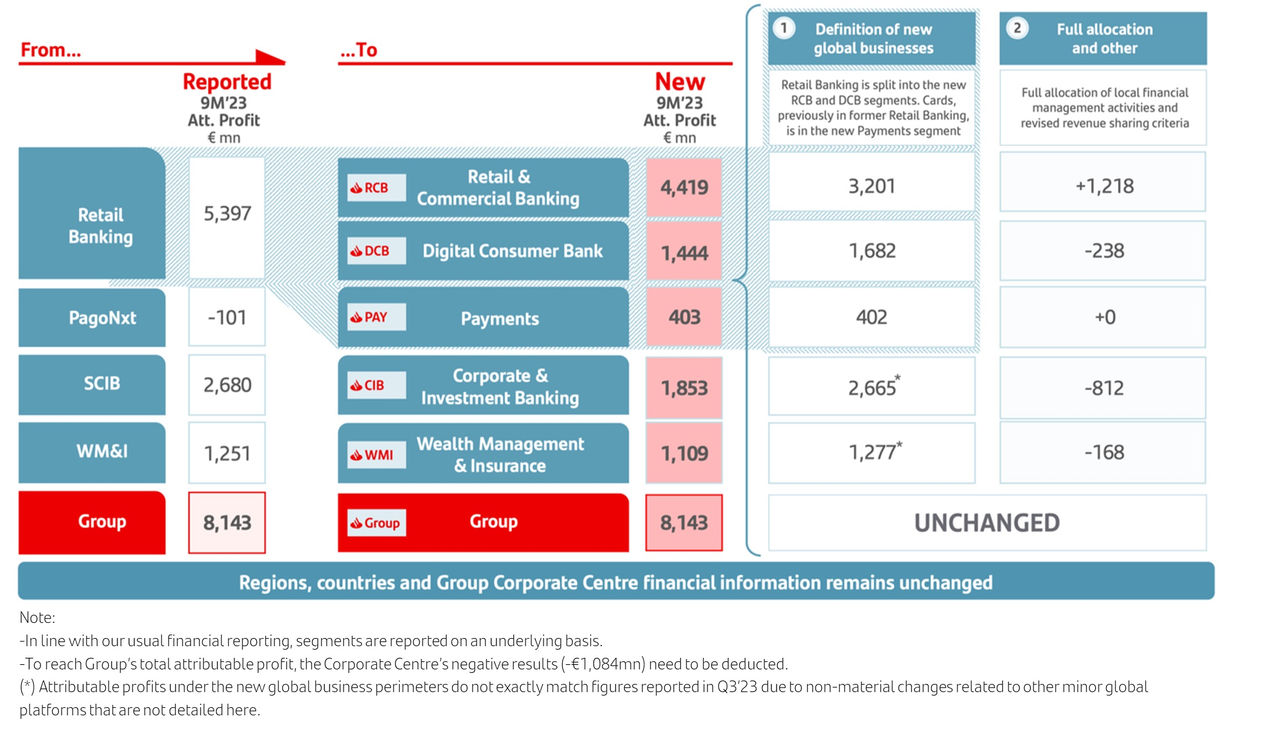

Santander has today published adapted financial disclosures for the past seven quarters to reflect the new operating model announced in September, in which the bank’s five global businesses will become the new primary reporting segments. The group’s consolidated results are not affected.

From the first quarter of 2024, the group’s activities will be reported under five global businesses, further aligning the bank’s operating model to its strategy and simplifying its business. This change will help the bank achieve the group’s strategic goals outlined at its Investor Day in February.

Madrid, 20 December 2023.

Santander has today published adapted financial disclosures for the past seven quarters to reflect the new operating model announced in September, in which the bank’s five global businesses will become the new primary reporting segments. Under the model, the bank’s activities will be consolidated from 2024 under:

- Retail & Commercial Banking: a new business area with all the bank’s retail and business banking globally.

- Digital Consumer Bank: consumer finance activity worldwide.

- Payments: PagoNxt and Global Cards.

- Corporate & Investment Banking (Santander CIB): already a global business.

- Wealth Management & Insurance: already a global business.

To facilitate year-on-year comparisons and analysis, the bank is adapting its financial reporting for the last seven quarters for each of these global businesses. These changes do not affect regions and countries, nor do they impact the group’s consolidated earnings.

According to the new reporting model, the five global areas will become the bank’s primary reporting segments from the first quarter of 2024, and regions and countries will continue to be reported publicly, but as secondary segments. The group’s 2023 annual earnings, to be announced on 31 January 2024, will be disclosed under both the current and new model to facilitate the transition.

Santander’s new operating model further aligns all the bank’s businesses to its strategy, while improving customer service as well as extracting the full potential of the bank’s global and in-market value, and running the bank through a simpler and more efficient operating model.

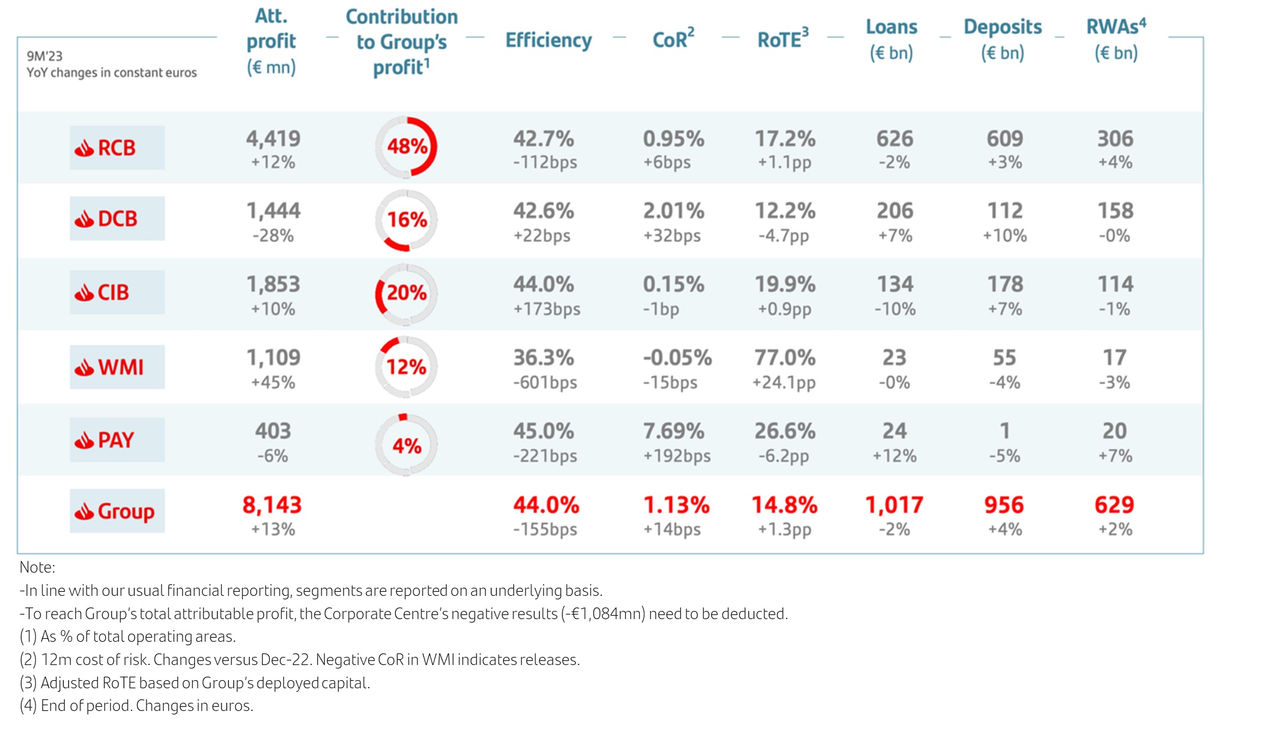

Santander’s group strategic goals remain unchanged and include achieving a return on tangible equity (RoTE) of 15-17% in 2023-2025 and an efficiency ratio of c.42% by 2025; maintaining a fully-loaded CET1 above 12%; and delivering double-digit average annual growth in tangible net asset value (TNAV) per share plus dividend per share through the cycle.

With the new model, results from activities related to financial management that are currently in the countries are fully allocated to the global businesses and the revenue sharing criteria have been reviewed to better reflect the value added by the bank’s branch network. Consequently, global businesses’ results are different to previous financial reports as reflected below.

Breakdown of main financial impacts by attributable profit and business

Main financial figures by global businesses

A presentation with more details about this announcement, and income statements and other key metrics of the last seven quarters for every global business, is available at CNMV and here.